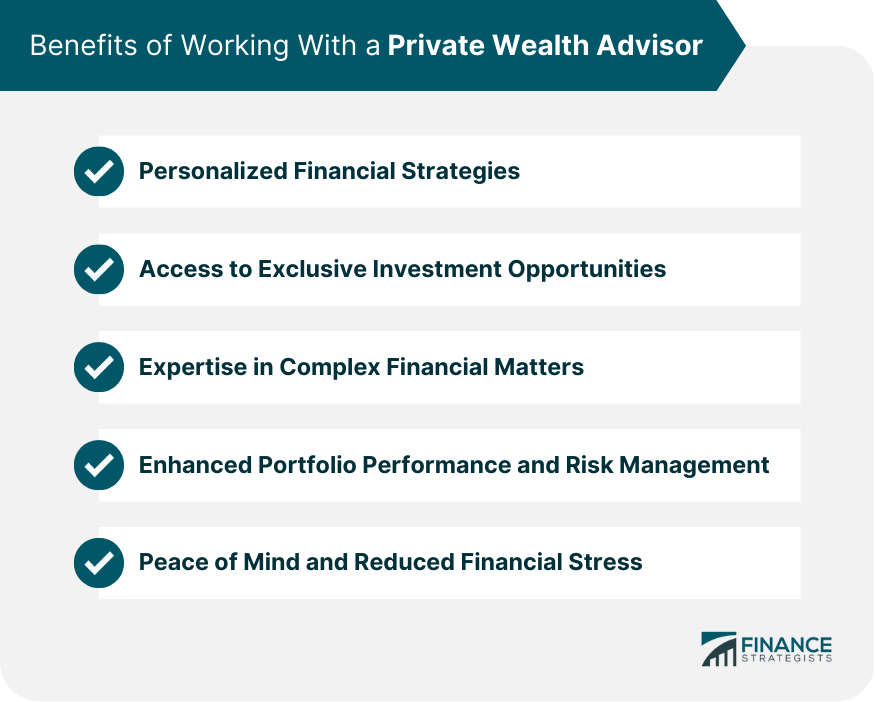

As you accumulate more wealth and get older, you likely have specific financial goals that you want to achieve. This may range from growing your wealth, saving for retirement, or achieving financial independence. Whatever your goals may be, working with a wealth planner can help you plan for them. Here are the benefits of working with a wealth manager:

Streamlining Your Financial Plan

When you are facing a challenge managing your investments, it’s time to work with a wealth advisor. You can state your goals and what you expect to achieve, and the financial advisor drafts an investment plan for you. This means you don’t have to worry about constantly monitoring the market, as your wealth manager will take care of it for you. They will ask you about your risk tolerance to determine how to invest your money.

Your future financial goals are laid out in a clear and concise manner, making it easier for you to understand and follow. You will also have someone with experience in financial markets and investments helping to guide you toward your goals. When you have a professional financial advisor working with you, you are more likely to avoid common errors like emotional investing.

Managing Investments

Your investment requires active management as market conditions change regularly. With the help of an expert, you could make adjustments to your portfolio to prepare for or adjust to these changes. The market can take a temporary downturn, or a new opportunity may arise. A financial planner helps you prepare for these occurrences. If you choose to work with a wealth planner, you benefit from informed decisions based on data analysis and market trends. You may be better equipped to withstand market turbulence, making your portfolio less vulnerable to market changes.

Minimizing Your Tax Burden

Investors become integral parts of national economic expansion, which stimulates national advancement by participating in the economy. Investment profits can decrease due to taxes if you fail to diversify and manage your funds appropriately. Working with managers experienced in tax laws enables you to reduce your overall tax responsibility by investing in tax-sheltered accounts or donating to charitable causes.

Advantageous investment solutions designed to minimize taxes can be implemented by working with a planning professional. You decrease your tax expenses through investments in tax-advantaged accounts designed as individual retirement accounts. Investments under tax compliance continue to grow until you withdraw funds during retirement.

Preserving Your Legacy

Your business and investment holdings are part of your financial legacy. The livelihood and future of your dependents can be secured by planning early for successors and allocations. You may establish a trust or family foundation to maintain and distribute your assets according to your wishes. A wealth planner assists you in creating a plan that outlines the management and distribution of assets.

Get Help from A Wealth Planner

A wealth planner helps you understand and prioritize your financial goals. From retirement planning to saving for education, you get expert advice and guidance on how to expand your wealth. Contact a wealth advisor today to discuss your financial goals and how to achieve them.

- How Bail Bondsmen Help Families Navigate the Legal System

- Maximizing Productivity in Your Office Space Through Thoughtful Design

- The Benefits of Working With an Attorney for Your Car Accident

- How to Choose the Right Lighting for Kitchen Remodeling

- Lifestyle And Cost Of Living Insights for Retiring In Panama